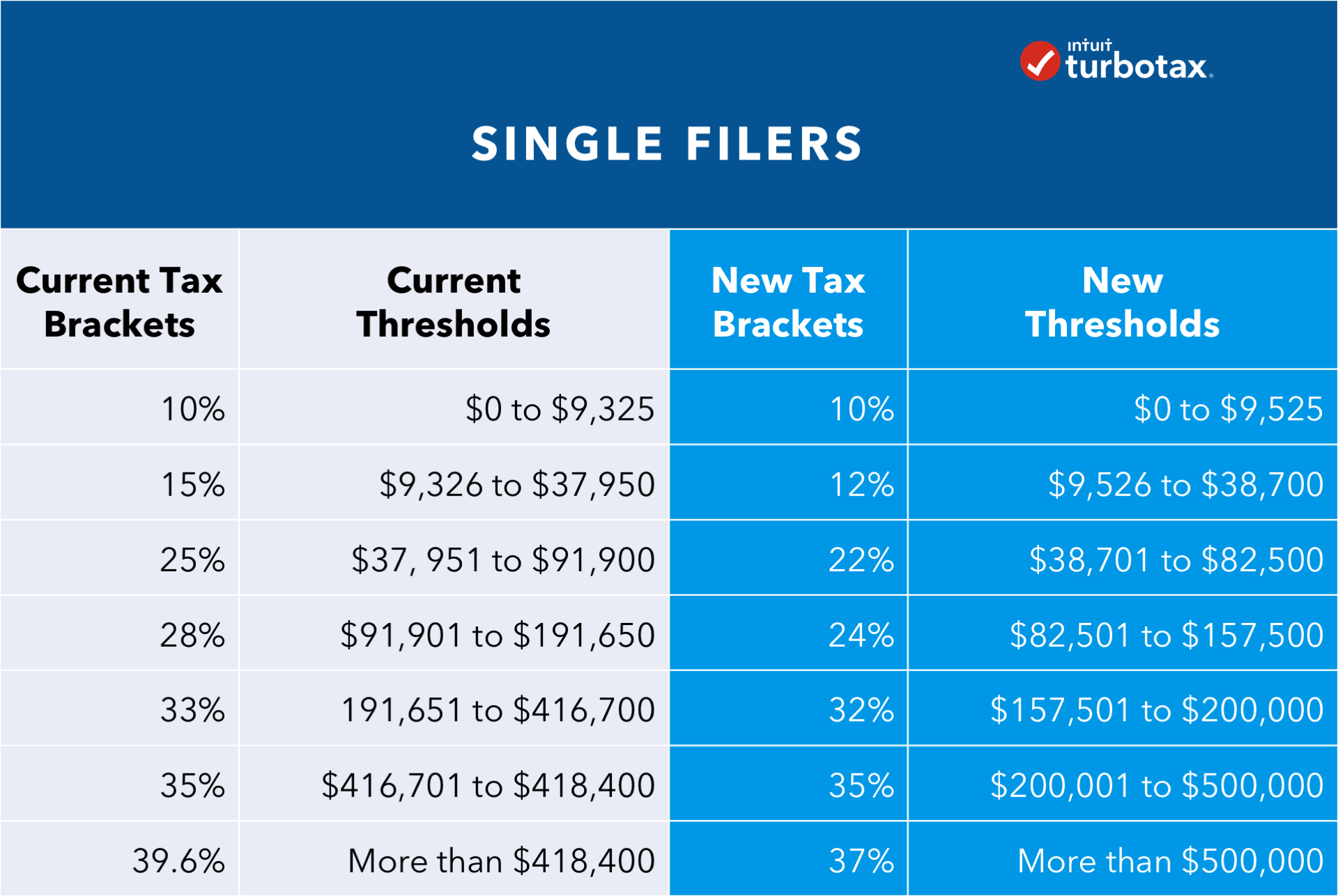

2025 Income Tax Brackets For Single Filers. 10, 12, 22, 24, 32, 35, and 37 percent. For the top individual tax bracket, the 2025 income threshold was raised from $578,126 to.

For single taxpayers and married individuals filing separately, the standard deduction rises to $14,600 for 2025, an increase of $750 from 2025; Let’s say you’re single and your 2025 taxable income is $75,000;

2025 Tax Brackets Single Filing Bren Marlie, For the tax year 2025, the top tax rate is 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly).

2025 Tax Brackets For Single Filers Magda Nancie, There are seven federal tax brackets for tax year 2025, and the irs has increased its income limits by about 5.4% in 2025 for each bracket.

2025 Tax Brackets Single Filer Erica Krystle, In 2025, the top tax rate of 37% applies to those earning over $609,350 for individual single filers, up from $578,125 last year.

Tax Brackets For 2025 Single Filers Nicky Kelley, For the top individual tax bracket, the 2025 income threshold was raised from $578,126 to.

Tax Brackets 2025 Single Filing Erma Benedetta, The tax rates continue to increase as someone’s income moves into higher brackets.

2025 Tax Brackets Married Jointly Single Latia Christyna, There are seven federal tax brackets for tax year 2025, and the irs has increased its income limits by about 5.4% in 2025 for each bracket.

2025 Tax Brackets For Single Filers Clari Constantine, But some of your income will be taxed in lower tax brackets: