The biggest opportunity is to realize capital gains prior to june 25, 2025. Homeowners are affected by capital gains tax when they sell their primary home.

Capital gains tax may not be the most exciting part of selling your home, but it’s important to know how it’ll impact your sale. In a nutshell, any net capital gain you make upon the sale of a second home is taxable at the appropriate rate (long term or short term).

This publication explains the tax rules that apply when you sell or otherwise give up ownership of a home.

Capital Gains Tax Rates 2025 Siana Dorothea, Budget may announce a higher tax rate of 30% to profits from derivatives trade. There are two main categories for capital gains:

Capital Gains Tax On Home Sale 2025 Wynny Karolina, You’ll pay a tax rate of 0%, 15% or 20% on gains from the sale of most assets or investments held. The rate goes up to 15 percent on capital gains if you make between.

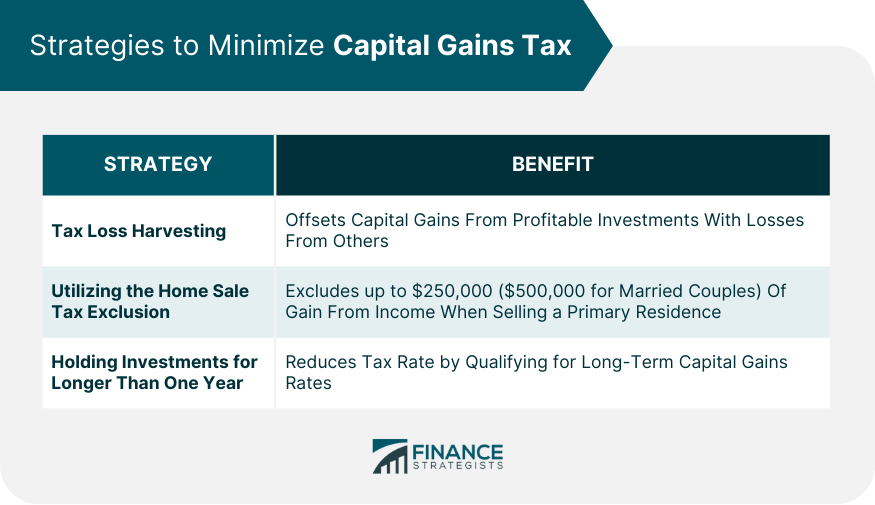

Capital Gains Tax Allowance 2025/24 Uk Emlyn Iolande, Some strategies to minimize capital gains tax in 2025 include tax loss harvesting, utilizing the home sale tax exclusion, and holding investments for longer than. For the 2025 tax year, you won’t pay any capital gains tax if your total taxable income is $47,025 or less.

2025 Capital Gains Tax Rates Alice Brandice, The profit you make when you sell your stock (and other similar assets, like real estate) is equal to your capital gain on the sale. The 2025 federal budget proposes to increase the capital gains tax inclusion rate to 66.67%.

2025 Tax Rates Capital Gains April Brietta, The profit you make when you sell your stock (and other similar assets, like real estate) is equal to your capital gain on the sale. Let’s take a closer look at the capital gains tax, including what it means and how.

Real Estate Capital Gain Tax Rate 2025 Ange Maggie, The 2025 federal budget proposes to increase the capital gains tax inclusion rate to 66.67%. The rates are 0%, 15% or 20%, depending on your taxable.

Capital Gains Tax Brackets for Home Sellers What’s Your Rate? Tax, If you own real estate property, such as a cottage, the ability to realize a capital gain is not as. The rate goes up to 15 percent on capital gains if you make between.

Capital Gains Tax Rate 2025 Calculator Real Estate Vivie Tricia, This publication explains the tax rules that apply when you sell or otherwise give up ownership of a home. How much you owe depends on your annual taxable income.

ShortTerm Capital Gains Tax Rate 20232024 Overview, The finance ministry plans to impose higher taxes on futures & options (f&o). Calculations of capital gain tax on sale of house property and exemption available under income tax act.

Capital Gains Tax Rate 2025 Overview and Calculation, You’ll pay a tax rate of 0%, 15% or 20% on gains from the sale of most assets or investments held. How much you owe depends on your annual taxable income.

In simple terms, this capital gains tax exclusion enables homeowners who meet specific requirements to exclude up to $250,000 (or up to $500,000 for married.